- #DIFFERENCE BOND STOCK MIX PORTFOLIO DRAWDOWN HOW TO#

- #DIFFERENCE BOND STOCK MIX PORTFOLIO DRAWDOWN SERIES#

Consider Roth conversions where appropriate.Use the opportunity to perform portfolio cleanup (review asset location, concentrated positions, and high-cost legacy positions).Perform tax-loss harvesting if appropriate.Rebalance the portfolio if allocations have drifted out of tolerance bands.Know that staying the course requires action Given recent experiences, do you have insight into the client's risk tolerance that might warrant a strategic change to their portfolio?.Consider language using success rate percentages rather than market return percentages.Įvaluate whether the client's circumstances have changed.Focus on progress toward and continued ability to meet goals-remind them to view short-term returns in a big-picture perspective and to keep track of "the numbers they care about" that represent long-term objectives.Take an EQ+IQ approach-that is, reinforce the "emotional intelligence" of empathetic understanding with your informed perspective as a financial professional.Following are a few things you can do to help clients feel supported and that they are continuing progress toward their goals. But it's often a different thing entirely to communicate the benefits of deliberate, patient action to clients-especially as they watch their portfolio balances dwindle. It's one thing for you to understand on an intellectual level how the market cycle is playing out. Seize opportunities amid the disappointment Sources: Vanguard analysis of Morningstar Direct data, as of March 31, 2022. Stock portion of portfolios is composed of Spliced US Equity as represented by the FT Wilshire 5000 Index from January 1, 1990, to JMSCI USA Investable Market Index from July 1, 1994, to Jand CRSP US Total Market Index thereafter. Aggregate Bond Index Float Adjusted thereafter. Aggregate Bond Index from January 1, 1990, to Jand Bloomberg U.S. Bond portion of portfolios is composed of Spliced US Bonds, as represented by Bloomberg U.S. Notes: Portfolios comprise the Spliced US Bond and Spliced US Equity return series, weighted according to their respective stock and bond allocations. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

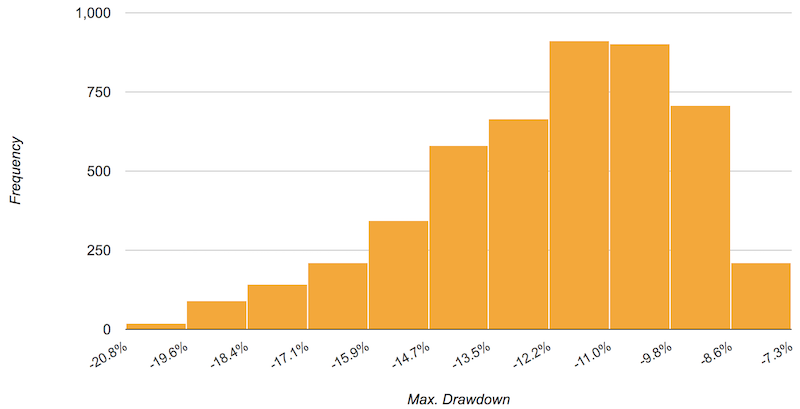

Past performance is no guarantee of future returns. equity/bond portfolios relative to history With inflation front-and-center in the news cycle, it's an opportune time to explain why holding periods, goals, objectives, and behaviors matter.ĭid Q1 2022 change the longer-term narrative?ĭistribution of rolling three-year returns of U.S. For example, stocks come with greater drawdown risk, but less purchasing power risk than do more conservative investments.

Here, you have an opportunity to reframe the conversation by educating clients on those other forms of risk.

#DIFFERENCE BOND STOCK MIX PORTFOLIO DRAWDOWN SERIES#

As you know, the Federal Reserve has commenced an anticipated series of interest rate hikes to stem inflation, and the effects are starting to reverberate throughout financial markets.

#DIFFERENCE BOND STOCK MIX PORTFOLIO DRAWDOWN HOW TO#

Your clients are most likely calling you with every headline looking for your guidance on how to adjust, if at all, their portfolio strategies.

0 kommentar(er)

0 kommentar(er)